How can we connect with users in a deep and meaningful way, if we don’t understand their cultural contexts?

After achieving success in Spain and France, a refurbished bike company encountered significant challenges when expanding into Germany, where previous strategies proved ineffective due to cultural consumer differences. We analyzed the motivations and trends shaping cycling culture in Germany to create a more effective digital strategy.

⚔️Problem:

Cultural differences between Spain/France and Germany in cycling consumption led to extremely low sales in Germany, with only one bike sold in an entire year.

🎯Objective:

Generate a deep analysis of the habits, motivations, and behavioral trends shaping cycling consumption in Germany, through a combination of qualitative research, user interviews, and behavioral testing. By doing this, we were able to identify key motivators, friction points, and opportunities specific to this market.

Executive summary of German consumer preferences & habits:

01. Consumer preferences in Germany

German consumers value quality, durability, and sustainability when purchasing bicycles and accessories, preferring domestic brands and eco-friendly options. They research thoroughly before buying and show a strong preference for MTB and road bikes, especially in rural areas. Additionally, there is a DIY maintenance culture and a growing interest in bike tourism.

Federal Ministry for Digital & Transport (Germany): https://bmdv.bund.de/SharedDocs/DE/Anlage/StV/fahrradmonitor-kurzfassung-englisch.pdf // ADFC Travel Analysis on cycling in Germany in 2022: https://www.ebike24.com/blog/adfc-bicycle-travel-analysis-germany-2022?utm

1.1 Preference for quality and durability, associated with domestic brands

The “Made in Germany” label is highly valued and preferred, as it is associated with durability, safety, and superior quality, even if it means a higher final price. Trust in local brands also reflects pride in national production, as these brands combine engineering excellence with a commitment to sustainability and high-quality manufacturing, aspects that are highly appreciated in the German market.

German cyclists prefer products that not only offer high performance but also withstand long-term wear, handling both the rigors of daily use and the demands of challenging routes.

When buying a bicycle, German cyclists particularly value:

1. Quality materials 2. Longevity 3. Performance

Some competitor online stores: Bike-Discount, MHW Bike-House GmbH, Canyon Bicycles GmbH, Rose Bikes, Fahrrad.de, Bikester. (Based on annual sales and revenue data)

💡 Although a small portion of the population consumes luxury products, German culture generally does not favor ostentatious consumption.

Sources: Federal Ministry for Digital & Transport (Germany): Link // ADFC Travel Analysis on cycling in Germany 2022: Link

1.2. Focus on sustainable consumption

There is a strong trend toward responsible consumption in Germany, including a preference for eco-friendly, recyclable, or fair-trade products. This is an important aspect to highlight during the digital experience. Additionally, German citizens are particularly committed to environmental protection, choosing products or activities that promote a greener lifestyle, such as cycling.

Given Germany’s strong commitment to sustainability, many brands and consumers prefer bicycles and cycling-related products manufactured in an eco-friendly way.

💡Emphasizing second-hand bike purchases or accessories made from recyclable and sustainable materials is essential as an added value.

Sources: Federal Ministry for Digital & Transport (Germany): Link // ADFC Travel Analysis on cycling in Germany 2022: Link // German Waste-to-Energy Report 2024-2029

1.3 Informed consumers

In general, German buyers are highly price-conscious and usually seek the best value for their money. They are willing to invest time in research and comparison and appreciate having operational control over their purchases.

They tend to research thoroughly before buying to ensure they choose durable, well-built bicycles. For this reason, price comparison platforms and discounts are very popular.

This German habit of careful research translates into very considered consumer behavior. Key aspects of this behavior include:

Thorough research · Influence of reviews · Trust in e-commerce · Preference for secure payments with invoices · Debt aversion, avoiding installment payments

💡German consumers need to be able to easily compare and contrast between products and features through reviews and other features.

💡German consumers avoid deferring payments and would rather save to invest in high quality products

Sources: Federal Ministry for Digital & Transport (Germany): Link // ADFC Travel Analysis on cycling in Germany 2022: Link // German Waste-to-Energy Report 2024-2029

1.4. Accessories and gear as a form of distinction

Bicycle-related accessories—such as helmets, lights, locks, and specialized clothing—represent a growing market. The use of comfortable, technical apparel (such as jerseys and cycling shorts) is common among frequent cyclists. In addition, a strong focus on safety drives high demand for locks, helmets, and other protective equipment.

Other essential accessories include:

· Waterproof panniers and bags · Insulated bottles and bottle cages · Ultralight saddles and handlebars · Handlebar accessories · Repair kits and hand pumps

💡Gear and accessories are important on many levels: safety, repairs, and as signaling to other cyclists.

Sources: Germany’s Cycling Enthusiasm: Key Trends Driving Bicycle Shoe Demand, Future Market Insights // ADFC Travel Analysis on Cycling in Germany (2022)

1. 5. Trend: Mountain bikes (MTB) and road bikes

Mountain bikes (MTB) and road bikes are in high and steadily growing demand, especially in cities close to rural areas and regions with extensive trails and mountainous terrain. It is estimated that 28% of German cyclists use mountain bikes.

The market is expected to reach $7,756.8 million by 2033, with a compound annual growth rate (CAGR) of 9.41% between 2023 and 2033. The German government is considering offering tax incentives for high-cost mountain bikes, which could further boost the sector.

💡The price of MTB is not a deterrent for German consumers, as many are already purchasing in that market. There are even aids from the government to invest in these vehicles.

Sources: Federal Ministry for Digital & Transport (Germany) / ADFC Travel Analysis on cycling in Germany (2022)

1. 6. Repair and care: Do It Yourself (DIY)

Given the long history of cycling in Germany and its deep roots in society, most German cyclists have basic knowledge of bicycle repair and maintenance. This practice fosters a strong sense of attachment to their bikes.

In addition, German law requires bicycles to be properly equipped—with adequate lights and reflectors, for example—which reinforces a culture of regular maintenance to comply with these regulations.

Like the rest of Europe, Germany is experiencing growth in online shopping. However, this growing trend is combined with purchases in physical stores, as traditional retail remains very important in German culture. According to 2023 data, 74% of bicycles in Germany were purchased in brick-and-mortar specialty stores, while 26% were bought through specialized online retailers or exclusive online providers.

The repair culture is especially rooted in physical retail.

💡Repair culture over new purchases

Germans place great importance on maintaining their bicycles, which has led to a strong culture of care and durability. Specialized repair shops with highly qualified mechanics, the buying and selling of spare parts and components, and free public repair stations are common.

Germans place great importance on maintaining their bicycles, which has led to a strong culture of care and durability. Specialized repair shops with highly qualified mechanics, the buying and selling of spare parts and components, and free public repair stations are common.

This significantly extends the lifespan of bicycles, aligning with Germany’s strong commitment to sustainability. Products and services that support this mindset therefore gain a competitive advantage over others.

Source: Online Shopping Motives: An Empirical Investigation of Consumer Buying Behavior in Germany's Main Online Retail Segments

1.7. Bike Tourism

According to the ADFC, around 5 million German cyclists undertake multi-day bike trips each year. The most frequent destinations are within Germany (56%), but they also travel to other European countries, such as Switzerland, Austria, and Italy. Bicycles are seen as a tourism option, and Germany has numerous well-established bike tourism routes, such as the Rheinradweg and Via Claudia Augusta, which has boosted demand for trekking bikes and related accessories, such as panniers and camping gear.

The main motivators for German cyclists engaging in bike tourism, according to a 2022 cycling trends study, are:

· Enjoying the countryside and scenery · Staying active and fit during vacations · Using a sustainable mode of travel

Additionally, economic and health-related motivators also play a role in driving this type of tourism.

1.8. Cyclist Identity

According to a study by the Federal Ministry of Transport, cyclist identity is the key differentiator between those who see the bicycle as a functional tool versus a hobby. Although 39% regularly use a bicycle or pedelec, only 14% of respondents identify as cyclists. In contrast, 49% identify as car drivers.

💡Our target lies within that 14% who integrate cycling into their identity.

Source: Federal Ministry for Digital & Transport (Germany): Link

02. Consumer Habits

84% of Germans have made at least one purchase on a marketplace or direct retailer in the past 12 months. How do cyclists shop?

♻️Relationship with second-hand market

Since our bicycle company sells refurbished bikes, we first wanted to learn about Germany's relationship with second hand shopping. We learned that, in contrast with Spanish and French consumers, who tend to dislike the term second hand and associate it with lower quality, German consumers prefer to consume this way and like to be told directly about the origin of their products.

· Online second-hand consumption is easy for Germans to adopt. They are already familiar with buying second-hand, and benefit from the convenience of online commerce.

· Consumers tend to look for bargains and compare prices, knowing there is always a chance to find a product at a lower price that fits their budget, including in the second-hand market.

· Additionally, they are aware that buying second-hand items directly contributes to sustainable consumption.

A 2016 study suggests that second-hand purchasing is more a lifestyle choice than an economic necessity. Over half of German consumers (54%) reported buying second-hand products in the past 12 months.

💡Germany is among the top 3 countries for second-hand bicycle purchases.

Over half of German consumers (54%) report having purchased second-hand products in the past 12 months, with clothing and accessories being the most commonly bought items (36%). Sports and outdoor-related products account for 8% of second-hand purchases.

🚴♀️ Demographic data

Daily bicycle use in Germany is roughly equal between men and women, but men are more likely to choose cycling as a hobby and to spend on it. The hobby is often pursued in pairs, but women do not usually identify as cyclists or active consumers.

According to the Bund Deutscher Radfahrer (BDR), approximately 15–20% of registered cyclists are women.

39% of Germans aged 14 to 69 use a bicycle regularly—that is, daily or several times a week—either as a mode of transportation or for leisure purposes.

Sources: Federal Ministry for Digital & Transport (Germany): Bicycle Use in Germany Explaining Differences between Municipalities with Social Network Effects

🔁 Cyclist Habits

Regardless of gender, most people still travel with a partner, family, or friends. However, the proportion of those traveling alone is increasing, reaching 24% in 2022.

💸 Socio-economic data

Germany is among the European countries with the highest spending on bicycles and related products. There is strong demand for both conventional and electric bikes (spending ranges from €2,000 to €4,000 for a good-quality electric bike; in other countries, €1,500–3,000).

According to the European Consumer Behavior Study (2019), German consumers are generally prudent buyers, focused on rational, well-considered decisions with long-term benefits, which results in a low rate of impulsive purchases.

Source: 2021 Cycling Monitor Germany, Sinus // ADFC Travel Analysis on cycling in Germany in 2022

Behaviors & Profiling of a German Cyclist

🚴♂️They see cycling as a hobby, beyond just a means of transportation. For example, they ride long distances on weekends, take national or international trips, or cycle during vacations.

💶 They spend €1,500 or more annually on the hobby and often have a bike for every occasion, terrain, or trip.

🛠️👕 They invest in maintaining their bikes and in gear that sets them apart as cyclists.

🚵♀️🚴 Social component is important, both in-person and via social media. They often travel in groups, with friends, a partner, or family.

03. Expert interviews // Test Think Out Loud

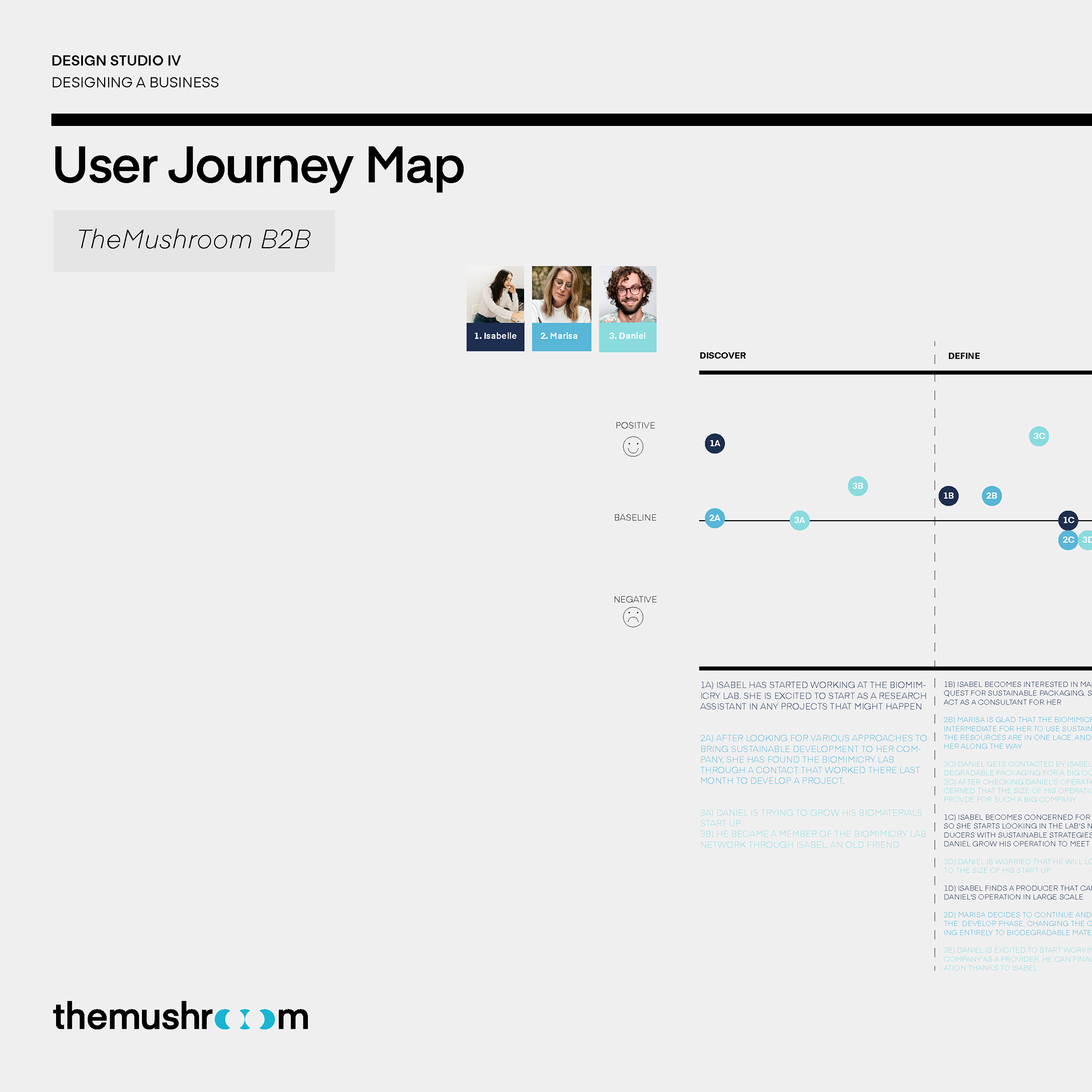

Profiles Interviewed

💻📱 Sample and Devices: Device usage: 70% mobile – 30% desktop.

👤Age distribution:

50% between 22–30 years

41.6% between 31–45 years

8% 46–60+ years

We interviewed a couple of cyclists, a cycling family, and several participants from cycling social groups or clubs.

➕Most German consumers have purchased second-hand items at least once in their life.

Among the cyclists interviewed:

· 7/12 have bought bicycles online at least once.

· 4/12 have made online purchases valued over €1,000.

· 2/12 have made high-value second-hand purchases at least once.

_____________________________________________________________________

04. MYTHS OF GERMAN CONSUMERS & THE REALITY

❌ Myth: German users prefer to shop via mobile.

✅ Reality: For high-value purchases, German users prefer larger screens. A broader, clearer view of the catalog gives them confidence and reduces mistakes.

🧠 E-commerce Recommendations:

· Focus marketing strategies on desktop web for better visualization, without neglecting mobile apps for exploration and brand curiosity.

· Reduce cognitive load and improve mobile usability, making product comparison on small devices easier.

· Present videos as short clips optimized for mobile (TikTok-style).

· Include “Add to Favorites” so users can explore on mobile and compare later on desktop.

_____________________________________________________________________

❌ Myth: German users need a virtual assistant to make decisions.

✅ Reality: German users prefer to make their own decisions. They value their own judgment and take their time, so the quality of information matters.

🧠 E-commerce Recommendations:

· Virtual assistants are supportive, but should play a secondary role.

· Users rely more on friends, family, and reviews than on assistants. Give more weight to user reviews.

· Provide clear information to support decisions.

· Foster a cyclist community, encouraging shared photos and experiences.

Behavioral Insight – Social Proof: ✅ We judge the value of a product based on whether others appreciate it.

_____________________________________________________________________

❌ Myth: We don’t sell online because German users prefer buying in-store.

✅ Reality: Bicycles do sell online. In-store purchases dominate due to gaps in the digital experience. The challenge is to offer the same confidence and guidance digitally as in a physical store.

🧠 E-commerce Recommendations – How to digitize physical inspection:

· Include visual aids to estimate size and weight · Highlight key product points visually, including cosmetic marks · Include videos of pedals, wheels, brakes, and handlebars, which users would normally test in-store

🧠 E-commerce Recommendations – How to digitize physical inspection:

Be clear about product trial periods: Several users who had purchased bicycles online—even second-hand—reported that they did so because the platform was very transparent about the bike’s condition and offered a trial period, which gave them confidence in their purchase. Interestingly, none of the users returned the bike.

_____________________________________________________________________

❌ Myth: They won’t want to spend much if it’s obvious the bikes are second-hand.

✅ Reality: The company’s prices aligned with German users’ expectations. But...

Price paradox: If the bikes are too cheap without explanation, it creates suspicion and distrust. Framing the quality of the bikes and being transparent about defects is key to how price is perceived.

To the right: Example of the product page redesigned to meet German expectations

❌ Myth: They can compare between bikes on our site easily

✅ Reality: None of the interviewed users were able to find the comparison tool.

🧠 E-commerce Recommendations – How to facilitate comparison:

· Make bike comparison visible and obvious, e.g., position it near filters.

· Reduce irrelevant information and focus on persuasive details, such as technical specs, quality, and warranty—minimize financing references.

· Be clear about the origin of prices and present them as a value gain.

· Be transparent about cosmetic marks in product images.

· Include visible comparison features on mobile to facilitate decision-making on any device.

· Add a comparison of carbon footprint and materials between a new bike vs. a refurbished bike on the platform.

Examples by Rose Bike & Canyon

_____________________________________________________________________

❌ Myth: Users prefer to pay in installments because the price is high.

✅ Reality: The German financial culture is not interested in financing. German consumers rarely spend beyond their means; they are more likely to save and purchase later than to pay in installments.

🧠 E-commerce Recommendations:

· Do not prioritize financing in prime space until the checkout stage, as it does not help users compare or explore.

· Keep financing options visible only at checkout.

· It’s fine to include Klarna as a payment method, but a dedicated section is unnecessary.

· Emphasize overall savings from buying refurbished rather than installment payments.

_____________________________________________________________________

They love the product. We just have to frame it correctly.

❌ Myth: Users don’t trust spending so much money online.

✅ Reality: Our website generates trust and confidence in the purchase. The issue is that it does not appeal to users’ key motivators.

🧠 E-commerce Recommendations – How to make the landing page address key motivators:

· Storytelling: Highlight sustainability, friendship, quality, and experience.

· Usability: Simplify information, reinforce friction points, and ensure clarity and transparency.

· Product framing: Present the product in its context and adventure, so cyclists understand why it matters and are persuaded.

And in reality, ... would they add to cart? Does the user feel they have all the information needed to make a purchase/add to cart?

In general, no. Only 2/12 users indicated they would purchase these bikes in a real scenario. The reason was not the product itself, but doubts and lack of information that were not resolved digitally.

🧠 Ecommerce Recommendations:

· Anticipate user doubts and needs · Support decision-making in a simple way · Facilitate comparison · Simplify information.

The German Legacy:

A symbolic universe centered on quality, repair, and responsible care, both for objects and the planet.